PSD2

Better protection for your payments.

On 1 January 2021, the Payment Services Directive 2 (PSD2) will introduce new security standards for credit cards. These standards will form the new guidelines for payment services. PSD2 requires what is known as strong customer authentication (SCA) via the 3-D Secure process. This ensures you are even better protected against fraud and abuse when making payments with your credit card online.

Activate your Degussa Bank corporate credit card for 3-D Secure now.

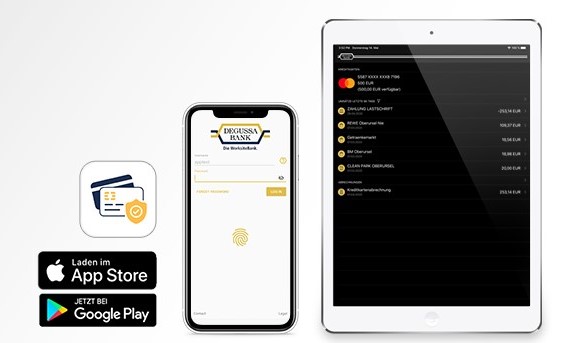

New: Degussa Bank My Card Manager App.

Always keep track of your business expenses.

- View your company card transactions on your smartphone

- Activate the 3-D Secure standard

- Approve transactions directly from your smartphone

Strong customer authentication (SCA) with two-factor authentication.

- Two-factor authentication through a combination of knowledge (PIN/password), possession (card/phone) and/or personal identification (biometrics)

- In-store using the Chip & PIN functionality

- Online using 3-D Secure (MasterCard Identity Check and Verified by Visa)

- Authentication by SMS-TAN + password or the My Card Manager app

Easier purchasing. Exceptions to strong customer authentication.

- Lodge cards used on B2B websites and My ePayment

- Low-risk transactions and low amounts (up to €30) in-store and online

- Regular payments to the same supplier

- Phone and mail orders with transmission of the card number

What will change.

- You will use the 3-D Secure process (MasterCard Identity Check and Visa Secure) to secure your transactions more often than before.

- Register for 3-D Secure easily, securely and quickly – here in the Corporate Cardholder Portal. Registration in your personal area only takes a few seconds.

- With our risk assessment of online transactions, you can continue to make many payments easily and without two-factor authentication in the future.